Postsecondary education can be a large financial investment for many families. A recent study published by the University of Georgia found student loan debt could be contributing to high levels of mental health issues, including depression, stress and worry. This rise in student loan debt has led many high schoolers and parents to consider alternative paths from the typical two- and four-year university route.

Although the path to success looks different for everyone, trade school programs can be a great alternative to college for many high schoolers looking to finish school faster and with less student loan debt than traditional college. Trade schools offer programs that feature hands-on training, helping your high schooler launch into a new career faster than a two- or four-year college. And with growing demand for trade professionals, parents have more reasons now than ever to support their high schooler’s decision to enroll in trade school.

This article focuses on the financial aspect of trade school and provides tips for parents to help prepare their high schoolers to invest in a trade school education.

Trade School Cost

The bottom line is many students in trade school pay less for their entire training program than they would for one year as part of an undergraduate four-year program. In comparison, trade school programs are a cost-effective way to earn an education and gain quicker entry into the workforce.

Trade school programs cost anywhere from $3,600 to $16,000 total, which is far less than most four-year degree programs. The main determinants of cost are the length and the type of training program your high schooler chooses. Other factors that affect cost include the location of the school, the type of institution and whether courses are offered online or in-person.

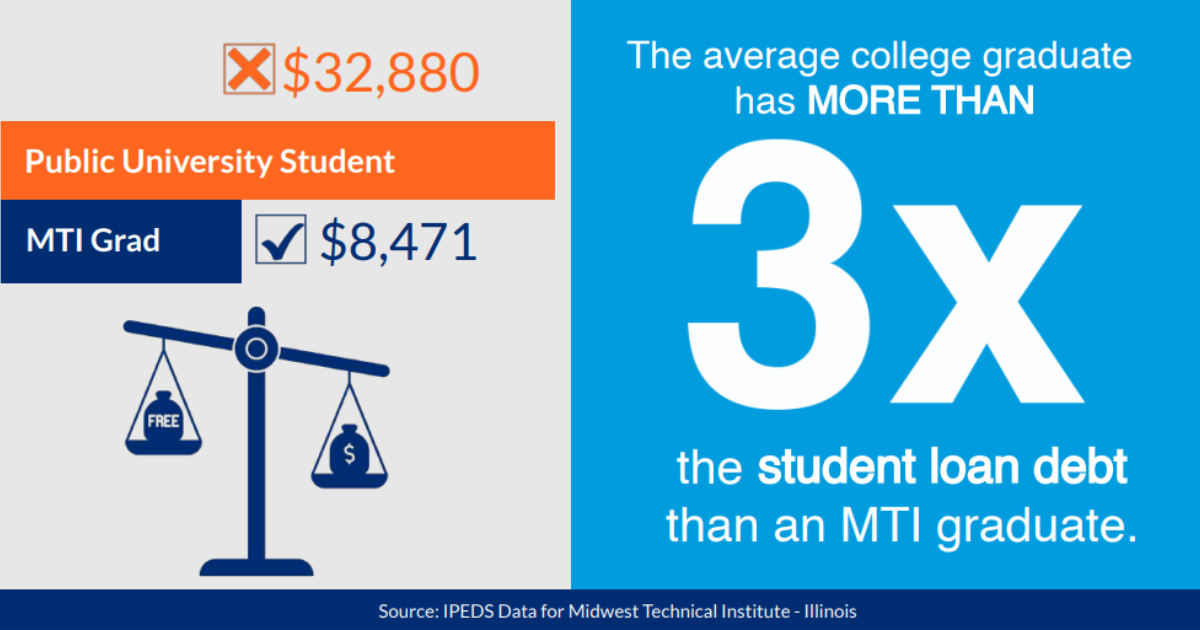

You can use online tools, such as the Net Price Calculator, to receive an estimate of how much students similar to your high schooler paid to attend Midwest Technical Institute (MTI) in 2021-22. The average student loan debt for an MTI graduate was just $8,471 in the 2021 school year.

To learn more about the difference in cost between trade school and college, check out our article Trade School vs. College: A Guide to Weighing Cost, Timelines and More.

Financial Aid for Trade School

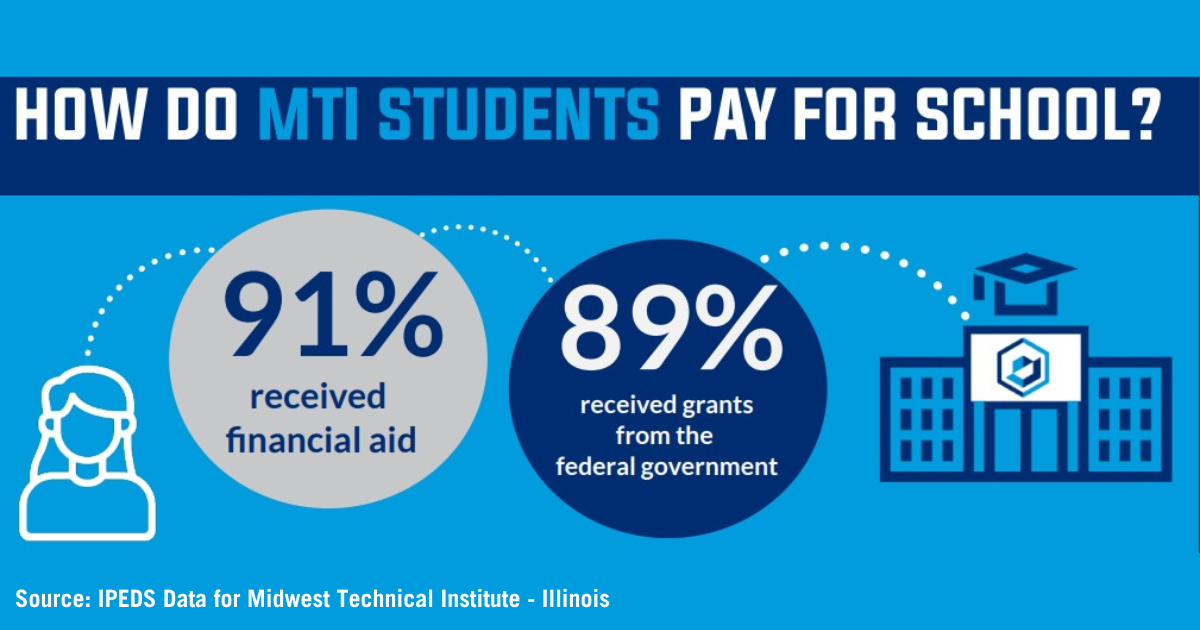

The Free Application for Federal Student Aid (FAFSA) is an important first step in finding out what financial aid your high schooler may qualify for, and it’s available not only for traditional college students but also to students in trade school.

Applying for financial aid can be an overwhelming process, but it’s worth investing the time to complete FAFSA as part of your senior’s trade school research.

Your high schooler can also get a ballpark estimate of their eligibility for federal financial aid by using an online calculator, like the Quick EFC. Tools like this provide an approximation of the financial aid they could qualify for when applying to trade school programs.

There are a few important things to know about applying for financial aid for trade school.

- There’s no fixed deadline for trade schools: Many trade schools offer rolling admissions, so typically there aren’t firm cut-off deadlines for your high schooler to apply for FAFSA or other types of financial assistance. Just make sure they use the appropriate income year when completing applications.

- You need to know the school code: To apply for federal financial aid, you fill out the FAFSA application. It will ask you for a school code. For example, the school code for MTI is 033683. You can find a school’s code by calling the school’s financial aid office or by calling the Federal Student Aid Information Center hotline at 1-800-4-FED-AID.

- You don’t have to apply alone: Many trade schools offer assistance with FAFSA applications. At MTI, our Financial Aid Team can assist you in completing your FAFSA. The High School Team at MTI also offers FAFSA workshops for seniors and their parents throughout the school year.

Interested in Learning More About Parent Resources?

Fill out the form below to receive info about our career training programs.

Student Loans for Trade School

Many accredited trade schools like MTI are approved by the U.S. Department of Education to participate in federally funded financial aid programs.

Not all students will qualify for federal financial aid, but it’s worth completing your FAFSA and meeting with the Financial Aid Team to explore what financial assistance may be available to your high schooler.

MTI offers a variety of federal student loan financing options to qualifying students, including the following:

- Federal Pell Grant William D. Ford Federal Direct Loan Programs

- Federal Direct Subsidized and Unsubsidized Stafford Loan (Student)

- Federal Direct PLUS Loan (Parents of Dependent Students)

Some students may consider private loans from banks as an alternative funding option. However, it’s important to do your research and consider interest rate and other factors that will impact the total cost of a private loan.

MTI’s Financial Aid Team offers many resources and information around student loans. Visit MTI’s student loan management resources to get answers to FAQs around student loans.

Tuition Reimbursement Opportunities

Many employers offer tuition assistance or reimbursement programs for students pursuing a career path in the skilled trades. Research tuition reimbursement programs as part of your financial planning for trade school.

At MTI, we partner with local employers to not only offer opportunities for our students to begin their career right after graduation, but also to help offset the cost of their training. MTI can work with your high schooler to find opportunities, such as our partnership with Springfield Clinic. Medical assisting students at MTI’s Springfield, IL campus can qualify for up to $10,000 in tuition reimbursement through Springfield Clinic’s Program.

Military Student Financial Aid

With military experience, your high schooler can utilize veterans’ education benefits to help fund their education. MTI’s eligible training programs for veterans include welding, HVAC/R, medical assisting, dental assisting and truck driving.

Students who currently or previously served in the military can also qualify for assistance through GI bills, including:

Visit MTI’s military student resource page for information on qualifications, eligibility and more.

Scholarships for Trade School

Many trade schools offer scholarship options. Scholarships can be internal programs created for a specific school, like MTI’s High School Scholarship Program, or scholarships funded by external foundations and industry organizations.

The High School Scholarship at MTI is not academic based. Instead, it focuses on your high schooler’s interest and passion for learning a skilled trade, such as welding, HVAC/R, medical assisting, dental assisting, truck driving or cosmetology. In 2023, nearly $300,000 in trade school scholarship funds were awarded to 88 high school seniors across Illinois and Missouri.

MTI also offers a list of external scholarships your senior may consider, such as the Mike Rowe Work Ethic Scholarship Program that supports the skilled trades and emphasizes the importance of work ethic, personal responsibility and a positive attitude.

At MTI, we can help match your high schooler with the best scholarship opportunities as part of the enrollment process. Your high school representative will assist you and your senior every step of the way, including working with the Financial Aid Team.

Is a Trade School Program Right for Your High Schooler?

Trade schools have earned a reputation as an alternative to college for those who can’t (or don’t) want to pay for a bachelor’s degree or those who feel they can’t commit to two or four years of education. Yes, it’s a great option for these students, but the massive shortage of skilled workers is creating issues for a variety of industries reliant on these skilled trade workers. In turn, that shortage presents an opportunity for those wanting to start a career in less time and at a lower cost than traditional college.

The skilled trades can be high-earning, fulfilling and noble career paths, including electrical, plumbing, HVAC/R, construction and other essential jobs. Many of these fields are also shielded from the negative effects of a struggling economy, providing long-term security and stability. Plus, your high schooler will enter the workforce sooner than their classmates who opted for the four-year college route, meaning they’ll begin earning money sooner and will have less student loan debt.

Here are a few key factors to keep in mind when considering trade school vs. college:

- Trade schools are highly focused on teaching students the relevant skills they need to land the entry-level job they want. Unlike a four-year academic college, trade schools don’t require any general education classes or credits that aren’t specifically related to the job at hand.

- The focused curriculum allows for accelerated training, making the program length much shorter. Less time will be required to complete your education, allowing for a faster route toward the first paycheck.

- Comparatively, trade school programs generally cost much less than a four-year college degree. Trade school costs will vary based on the type of program, the location and other factors. According to EducationData.org, the average public university student borrows $32,880 to attain a bachelor’s degree. That is more than triple the average student loan debt of an MTI grad.

To learn more, check out:

- The Ultimate Guide to Trade School for Parents

- How to Help Your High Schooler Choose the Right Career

Take the Next Step at MTI

If your high schooler is interested in MTI, we can connect you with a high school representative.

- Connect with a High School Representative. Your High School Representative will be your high schooler’s main contact throughout the enrollment process and can provide support all the way through graduation. To contact a high school representative, fill out a form to receive more information and get connected.

- Take a campus tour. Once you’ve connected with your High School Rep, they will schedule a campus tour for your high schooler to explore MTI’s labs and classrooms, learn about the programs, and explain the support available to help students succeed.

- Meet the Financial Aid Team. MTI’s Financial Aid Representatives are dedicated to helping students understand the options available to help pay for school, including federal financial aid, scholarships, grants and more. The Financial Aid Team can also assist you and your high schooler in filling out the FAFSA. Your High School Representative will schedule a meeting with the Financial Aid Team as part of the enrollment process.

Helpful Links

- What is a Trade School?

- Trade School vs. College: A Guide to Weighing Cost, Timelines & More

- High School Diploma vs. GED: What’s the Difference?

- High School Page

- Financial Aid Page

- Scholarships Page

- Tuition & Cost Page

- How Much Does Welding School Cost?

- How Much Does HVAC School Cost?

- How Can I Get My CDL in Missouri?

- How Can I Get My CDL in Illinois?

- How Long Does it Take to Become a Welder?

- How to Become a Medical Assistant in Illinois

Sources:

https://news.uga.edu/student-loan-debt-and-mental-health/

https://educationdata.org/college-tuition-inflation-rate

https://www.bls.gov/opub/ted/2023/consumer-prices-up-3-0-percent-over-the-year-ended-june-2023.htm

https://www.fastcompany.com/90828434/recession-jobs-may-fare-best

https://studentaid.gov/h/apply-for-aid/fafsa

https://finaid.org/calculators/quickefc/

https://studentaid.gov/help-center/answers/article/federal-direct-loan-program

https://studentaid.gov/understand-aid/types/loans/subsidized-unsubsidized

https://studentaid.gov/understand-aid/types/loans/plus

https://www.va.gov/education/about-gi-bill-benefits/post-9-11/

https://www.va.gov/education/about-gi-bill-benefits/montgomery-active-duty/